If you are interested in investing in an IPO you might be wondering how you can buy it. IPO shares are often underpriced and given to favored clients. However, the process of buying and selling IPO shares is quite different than buying and selling other kinds of stocks. Investing to an IPO requires a brokerage and FINRA restrictions. The following article will give you all the information you need in order to make the right choice.

IPO shares are allocated to favored clients

Many IPO investors are interested in knowing how their share allocations were determined. One example is that they might want to know if they are likely or not to be allocated in a previous IPO. It doesn't matter what the reason is, understanding how IPO shares work will allow them to set expectations. Listed below are some of the factors that determine whether or not you will receive an IPO share allocation.

When an IPO issuer decides how to distribute its IPO shares they consult with the company. Some companies prefer to distribute large blocks of shares directly to institutions. Others prefer to make the shares available to retail investors. These companies also tend to target large, wealthy investors to sell shares. They believe that such investors are more likely be to take financial risk, and will hold the investment for longer periods of time.

They are inexpensive

The common question in the investment community is "Why is an Ipo stock so low priced?" There are a number of reasons, including the fact that investors react poorly to news about the firm, and the idiosyncratic business model of the issuer. Ipo stock underpricing is further compounded due to the divergent goals of investors as well as issuers. Another possible reason is that the algorithms used for underpricing often deal in messy, complicated, and unorganized data. People often add to the data, creating irregularities that can then be covered up by artificial intelligence.

While underpricing is a common issue, it does not last long. Investor demand will eventually drive up the price to market. Nevertheless, this situation goes against the idea of market efficiency, and is especially prevalent in developing nations. Suppose a firm AMC offers its shares for $100 in its IPO. On its first day of trading, the price closes at $150. This is a 50% discount.

They are purchased through a brokerage account

Most likely, you have an IPO Stock in a brokerage account. Your shares can be sold online or through your broker. You can place a limit order to determine the price and number you wish to sell. Any profits you make on shares less than one-year old are generally subject to tax as ordinary income. This rate is usually higher that the long-term capital gain rate. Taxes are also applicable to IPO stock.

They are subjected FINRA regulations

Are IPO shares subject to FINRA regulations? Yes, it is. FINRA (the financial regulatory authority) prohibits members participating in new offering if they have a conflict. People in high-ranking positions, brokers or close family members are all subject to these restrictions. FINRA members can't allocate new issues for certain accounts unless the meet additional requirements. These include escrowing funds and limiting sales in discretionary accounts.

FINRA is comprised of 16 U.S. regions offices. It has a board made up of the chief executive officer and president of NYSE Regulation. FINRA regulates the securities industry and also oversees trade reporting and over-the-counter operations. FINRA members must comply with the regulations of National Association of Securities Dealers.

FAQ

Do I need knowledge about finance in order to invest?

You don't require any financial expertise to make sound decisions.

All you really need is common sense.

Here are some simple tips to avoid costly mistakes in investing your hard earned cash.

First, be careful with how much you borrow.

Don't go into debt just to make more money.

Be sure to fully understand the risks associated with investments.

These include inflation and taxes.

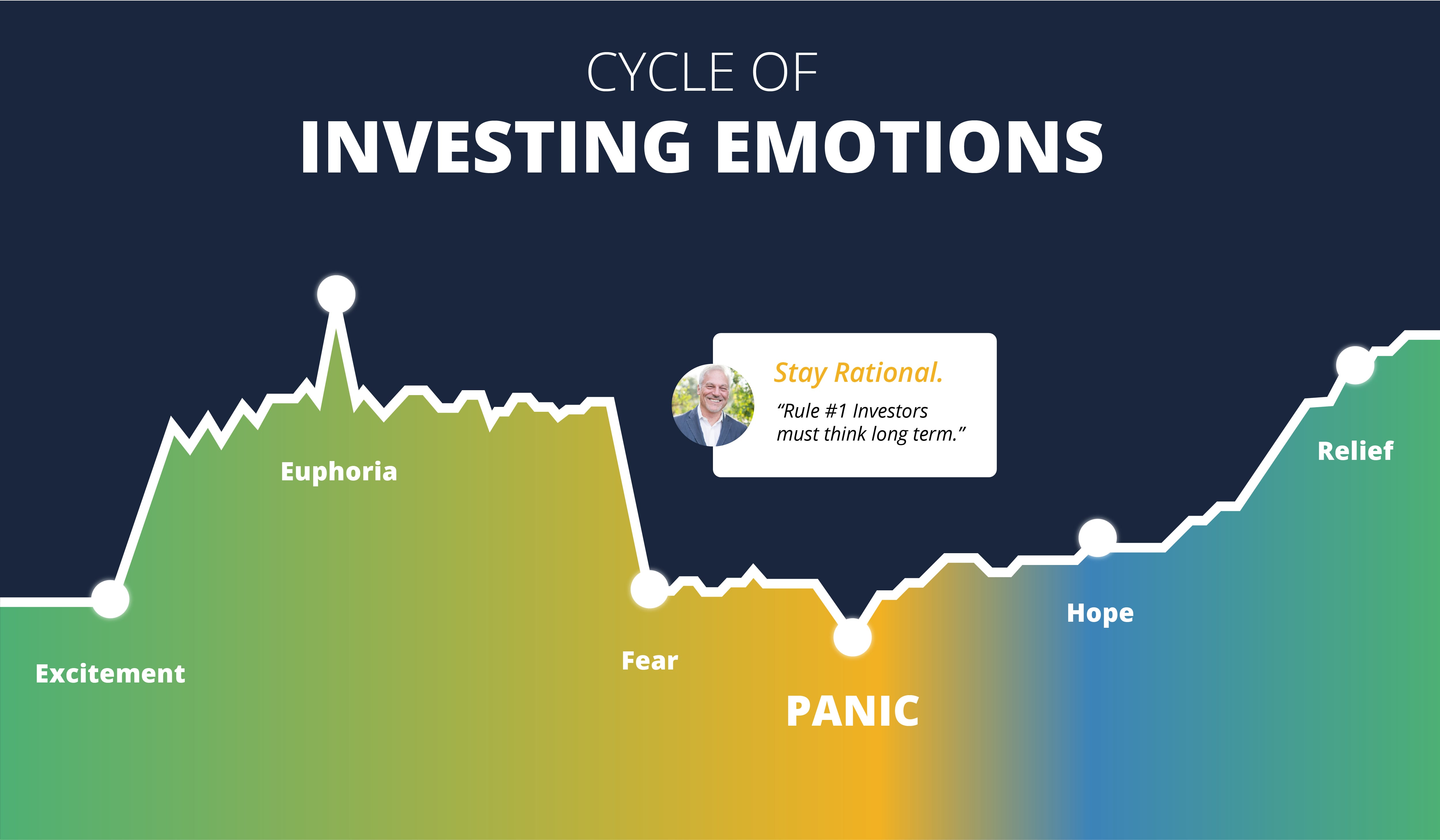

Finally, never let emotions cloud your judgment.

Remember that investing is not gambling. It takes discipline and skill to succeed at this.

These guidelines will guide you.

Which fund is best suited for beginners?

The most important thing when investing is ensuring you do what you know best. FXCM, an online broker, can help you trade forex. They offer free training and support, which is essential if you want to learn how to trade successfully.

If you feel unsure about using an online broker, it is worth looking for a local location where you can speak with a trader. This way, you can ask questions directly, and they can help you understand all aspects of trading better.

The next step would be to choose a platform to trade on. CFD platforms and Forex trading can often be confusing for traders. Both types trading involve speculation. Forex is more profitable than CFDs, however, because it involves currency exchange. CFDs track stock price movements but do not actually exchange currencies.

Forex makes it easier to predict future trends better than CFDs.

Forex can be very volatile and may prove to be risky. CFDs can be a safer option than Forex for traders.

To sum up, we recommend starting off with Forex but once you get comfortable with it, move on to CFDs.

Can I get my investment back?

You can lose it all. There is no guarantee of success. But, there are ways you can reduce your risk of losing.

One way is diversifying your portfolio. Diversification reduces the risk of different assets.

You can also use stop losses. Stop Losses allow shares to be sold before they drop. This reduces the risk of losing your shares.

Finally, you can use margin trading. Margin trading allows you to borrow money from a bank or broker to purchase more stock than you have. This increases your profits.

How do I determine if I'm ready?

It is important to consider how old you want your retirement.

Are there any age goals you would like to achieve?

Or would that be better?

Once you have established a target date, calculate how much money it will take to make your life comfortable.

Next, you will need to decide how much income you require to support yourself in retirement.

Finally, you need to calculate how long you have before you run out of money.

How do I start investing and growing money?

Learn how to make smart investments. By doing this, you can avoid losing your hard-earned savings.

Also, you can learn how grow your own food. It is not as hard as you might think. With the right tools, you can easily grow enough vegetables for yourself and your family.

You don't need much space either. It's important to get enough sun. Plant flowers around your home. They are very easy to care for, and they add beauty to any home.

Consider buying used items over brand-new items if you're looking for savings. They are often cheaper and last longer than new goods.

Can I invest my 401k?

401Ks make great investments. But unfortunately, they're not available to everyone.

Most employers offer their employees two choices: leave their money in the company's plans or put it into a traditional IRA.

This means that you are limited to investing what your employer matches.

You'll also owe penalties and taxes if you take it early.

What are the best investments for beginners?

Investors who are just starting out should invest in their own capital. They need to learn how money can be managed. Learn how retirement planning works. How to budget. Learn how you can research stocks. Learn how to read financial statements. How to avoid frauds How to make informed decisions Learn how you can diversify. How to protect yourself from inflation Learn how you can live within your means. How to make wise investments. Learn how to have fun while you do all of this. You'll be amazed at how much you can achieve when you manage your finances.

Statistics

- An important note to remember is that a bond may only net you a 3% return on your money over multiple years. (ruleoneinvesting.com)

- Most banks offer CDs at a return of less than 2% per year, which is not even enough to keep up with inflation. (ruleoneinvesting.com)

- According to the Federal Reserve of St. Louis, only about half of millennials (those born from 1981-1996) are invested in the stock market. (schwab.com)

- Some traders typically risk 2-5% of their capital based on any particular trade. (investopedia.com)

External Links

How To

How to save money properly so you can retire early

Retirement planning is when you prepare your finances to live comfortably after you stop working. It is where you plan how much money that you want to have saved at retirement (usually 65). You should also consider how much you want to spend during retirement. This includes things like travel, hobbies, and health care costs.

You don't need to do everything. Many financial experts can help you figure out what kind of savings strategy works best for you. They'll examine your current situation and goals as well as any unique circumstances that could impact your ability to reach your goals.

There are two main types of retirement plans: traditional and Roth. Traditional retirement plans use pre-tax dollars, while Roth plans let you set aside post-tax dollars. It depends on what you prefer: higher taxes now, lower taxes later.

Traditional retirement plans

Traditional IRAs allow you to contribute pretax income. You can contribute up to 59 1/2 years if you are younger than 50. You can withdraw funds after that if you wish to continue contributing. After turning 70 1/2, the account is closed to you.

If you have started saving already, you might qualify for a pension. These pensions vary depending on where you work. Matching programs are offered by some employers that match employee contributions dollar to dollar. Some offer defined benefits plans that guarantee monthly payments.

Roth Retirement Plans

Roth IRAs allow you to pay taxes before depositing money. When you reach retirement age, you are able to withdraw earnings tax-free. However, there are some limitations. For example, you cannot take withdrawals for medical expenses.

Another type of retirement plan is called a 401(k) plan. These benefits may be available through payroll deductions. Extra benefits for employees include employer match programs and payroll deductions.

401(k), plans

Most employers offer 401k plan options. They allow you to put money into an account managed and maintained by your company. Your employer will automatically contribute a percentage of each paycheck.

Your money will increase over time and you can decide how it is distributed at retirement. Many people decide to withdraw their entire amount at once. Others spread out their distributions throughout their lives.

There are other types of savings accounts

Some companies offer different types of savings account. TD Ameritrade allows you to open a ShareBuilderAccount. You can also invest in ETFs, mutual fund, stocks, and other assets with this account. Plus, you can earn interest on all balances.

Ally Bank can open a MySavings Account. You can use this account to deposit cash checks, debit cards, credit card and cash. This account allows you to transfer money between accounts, or add money from external sources.

What's Next

Once you know which type of savings plan works best for you, it's time to start investing! First, choose a reputable company to invest. Ask family and friends about their experiences with the firms they recommend. Check out reviews online to find out more about companies.

Next, figure out how much money to save. Next, calculate your net worth. Net worth can include assets such as your home, investments, retirement accounts, and other assets. It also includes liabilities such debts owed as lenders.

Divide your net worth by 25 once you have it. This is how much you must save each month to achieve your goal.

For instance, if you have $100,000 in net worth and want to retire at 65 when you are 65, you need to save $4,000 per year.