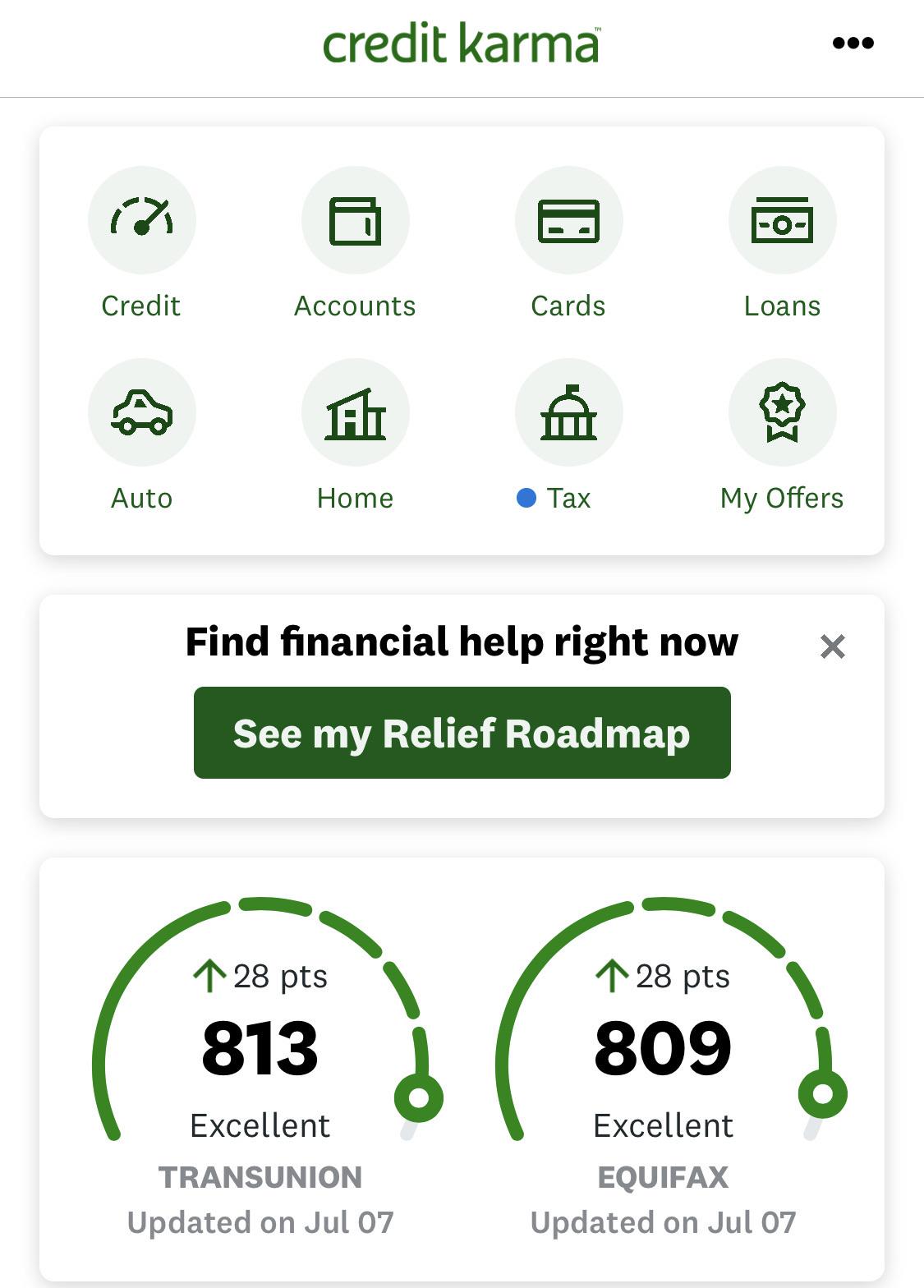

Before you can start a credit repair plan for bad credit, it's important to understand what constitutes a "bad” credit score. Lenders use this number to assess potential borrowers. It can range from 300 to 850. A subprime score could be defined as not meeting a lender’s minimum credit score requirement. High credit utilization rates can also play a role. Understanding these factors is essential for the successful repair of your credit.

A subprime credit score

A subprime credit score means that you will likely pay more interest than you should. Credit Builders Alliance shows that people with subprime credits will spend $200k higher in interest during their lifetime. Consumers with 720 FICO(r), will pay $4,020 less for a $10,000 auto loan. This is an average savings of $67 per monthly.

Even if you pay off the balance in full each month, having a subprime credit score will cost you a lot in interest. You may also have to pay a monthly or annual fee for some financing products. Although a subprime score might not affect your chances of approval, it can still make you less likely to get approved. There are steps you can do to raise your credit score.

Not meeting a lender's minimum credit score requirement

If your credit score is low, you might have a hard time finding a mortgage or renting an apartment. Lenders are unlikely to approve you for loans if your FICO score falls below 580. Lenders won't approve applicants without excellent credit scores. You may be asked to pay a higher deposit, or for the first and last months rent upfront by a landlord. You'll need to pay all the rent upfront if your credit is poor.

A high credit utilization rate

A high credit utilization is bad for your credit score. However there are ways that you can reduce it. First, limit your credit usage to 30% per month. Experts recommend you limit your credit usage to 10%. High credit card use is considered a red flag by lenders as it indicates that you have financial difficulties. A high credit utilization ratio can reduce your credit score by 50 points.

While having a high credit utilization rate is a factor in your overall score, it will only affect your FICO rating by a small amount. Your credit score will be slightly lower, but should rebound soon. A high credit utilization rate can lower your score if you are building credit histories. Although there is no formula to calculate this factor, it can have a negative impact on your credit score.

FAQ

What do I need to know about finance before I invest?

No, you don’t have to be an expert in order to make informed decisions about your finances.

You only need common sense.

Here are some tips to help you avoid costly mistakes when investing your hard-earned funds.

Be careful about how much you borrow.

Do not get into debt because you think that you can make a lot of money from something.

It is important to be aware of the potential risks involved with certain investments.

These include inflation, taxes, and other fees.

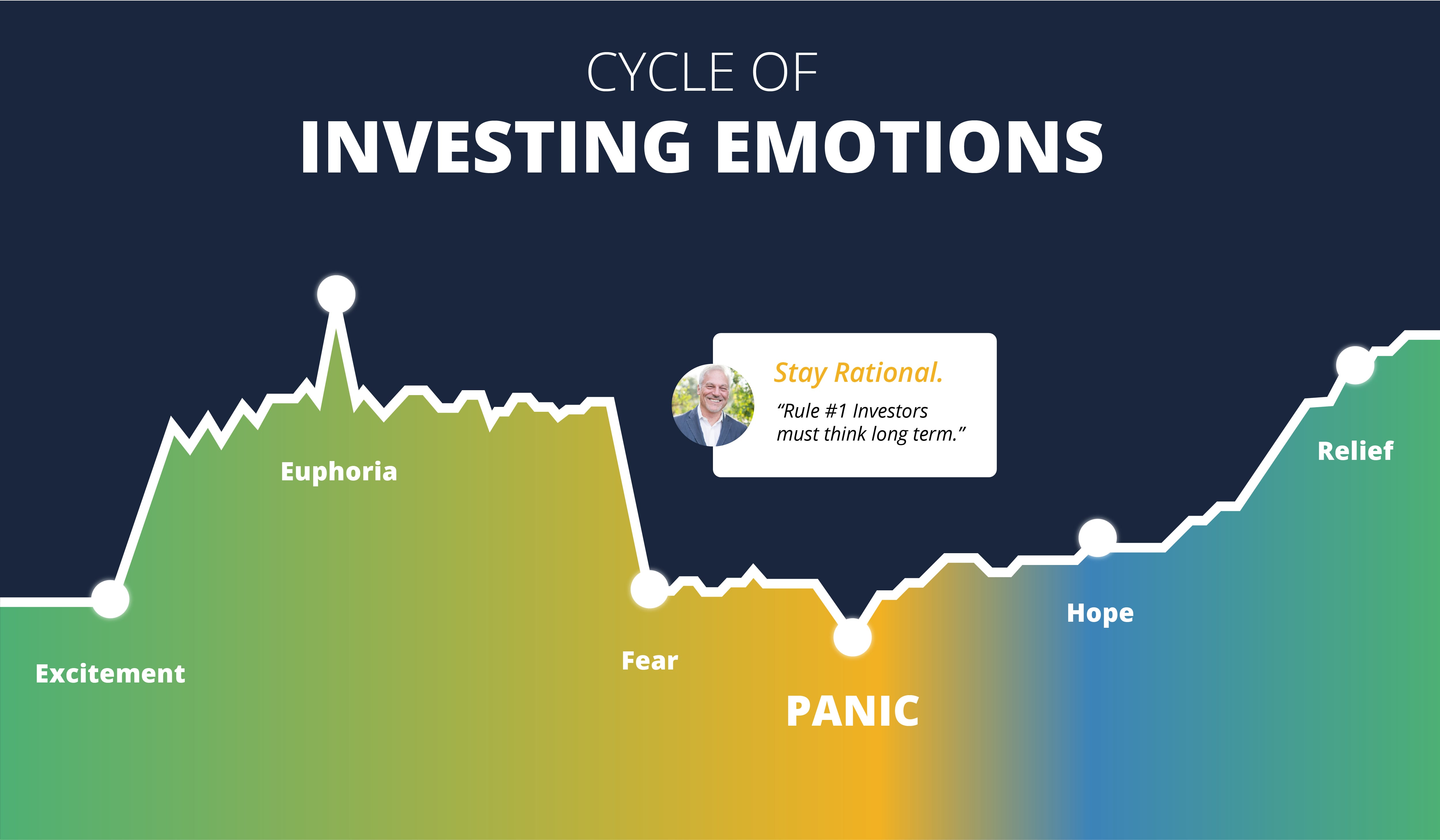

Finally, never let emotions cloud your judgment.

Remember that investing is not gambling. To succeed in investing, you need to have the right skills and be disciplined.

As long as you follow these guidelines, you should do fine.

Should I invest in real estate?

Real estate investments are great as they generate passive income. They require large amounts of capital upfront.

Real Estate is not the best choice for those who want quick returns.

Instead, consider putting your money into dividend-paying stocks. These stocks pay out monthly dividends that can be reinvested to increase your earnings.

Which investments should a beginner make?

Start investing in yourself, beginners. They should learn how manage money. Learn how retirement planning works. Learn how budgeting works. Find out how to research stocks. Learn how to read financial statements. Learn how to avoid falling for scams. How to make informed decisions Learn how to diversify. Learn how to protect against inflation. How to live within one's means. Learn how to invest wisely. This will teach you how to have fun and make money while doing it. You'll be amazed at how much you can achieve when you manage your finances.

How do I determine if I'm ready?

First, think about when you'd like to retire.

Is there a particular age you'd like?

Or would that be better?

Once you have set a goal date, it is time to determine how much money you will need to live comfortably.

Next, you will need to decide how much income you require to support yourself in retirement.

Finally, determine how long you can keep your money afloat.

Can I make my investment a loss?

Yes, you can lose everything. There is no way to be certain of your success. There are however ways to minimize the chance of losing.

Diversifying your portfolio is one way to do this. Diversification can spread the risk among assets.

Another way is to use stop losses. Stop Losses allow shares to be sold before they drop. This reduces your overall exposure to the market.

Margin trading is also available. Margin Trading allows you to borrow funds from a broker or bank to buy more stock than you actually have. This increases your chance of making profits.

Statistics

- According to the Federal Reserve of St. Louis, only about half of millennials (those born from 1981-1996) are invested in the stock market. (schwab.com)

- Some traders typically risk 2-5% of their capital based on any particular trade. (investopedia.com)

- An important note to remember is that a bond may only net you a 3% return on your money over multiple years. (ruleoneinvesting.com)

- 0.25% management fee $0 $500 Free career counseling plus loan discounts with a qualifying deposit Up to 1 year of free management with a qualifying deposit Get a $50 customer bonus when you fund your first taxable Investment Account (nerdwallet.com)

External Links

How To

How to Invest with Bonds

Bonds are one of the best ways to save money or build wealth. You should take into account your personal goals as well as your tolerance for risk when you decide to purchase bonds.

You should generally invest in bonds to ensure financial security for your retirement. Bonds offer higher returns than stocks, so you may choose to invest in them. Bonds might be a better choice for those who want to earn interest at a steady rate than CDs and savings accounts.

You might consider purchasing bonds with longer maturities (the time between bond maturity) if you have enough cash. They not only offer lower monthly payment but also give investors the opportunity to earn higher interest overall.

There are three types to bond: corporate bonds, Treasury bills and municipal bonds. Treasuries bill are short-term instruments that the U.S. government has issued. They are very affordable and mature within a short time, often less than one year. Large companies, such as Exxon Mobil Corporation or General Motors, often issue corporate bonds. These securities generally yield higher returns than Treasury bills. Municipal bonds are issued from states, cities, counties and school districts. They typically have slightly higher yields compared to corporate bonds.

When choosing among these options, look for bonds with credit ratings that indicate how likely they are to default. High-rated bonds are considered safer investments than those with low ratings. It is a good idea to diversify your portfolio across multiple asset classes to avoid losing cash during market fluctuations. This helps to protect against investments going out of favor.